Wage Claim Lawyer Washington, DC

Washington Wage Claim Lawyer

A Washington, DC wage claim lawyer knows that if you are dealing with overtime issues at your work, it may be time to seek legal help. Overtime violations happen when employers do not give eligible employees fair compensation when the employee works additional hours that go beyond the typical workweek hours. When this is the case, it is time to seek legal help from a team you know you can rely on during this difficult time. You have the right to fair compensation and anything less than that undermines fair labor practices. When you need help with your wage claim, turn to the team at Eric Siegel Law.

Table Of Contents

- Causes Of Wage Claims

- Types Of Wage And Hour Violations

- Consequences Of Wage Claims

- What Evidence A Wage Claim Lawyer May Use

- Wage Claim Infographic

- Frequently Asked Questions About Wage Claims In Washington DC

- For Legal Help Contact Eric Siegel Law

Navigating the intricate landscape of employment law often necessitates the expertise of a seasoned professional, and when it comes to disputes over wages, a wage claim lawyer emerges as a crucial ally. In the intricate dance between employers and employees, where financial remuneration is the focal point, these legal experts play a pivotal role in ensuring that workers receive their due compensation and that justice prevails in the realm of workplace remuneration.

Causes of Wage Claims

A wage claim lawyer is a legal professional who specializes in addressing disputes related to compensation and remuneration in the workplace. This can encompass a wide array of issues, ranging from unpaid wages and overtime violations to disputes over commissions and bonuses. With a nuanced understanding of labor laws, these lawyers act as advocates for employees, striving to safeguard their rights and secure the financial compensation they rightfully deserve.

Wage claims arise when employees assert that their employers have not properly compensated them according to labor laws and agreements. These claims can stem from various issues:

Misclassification of Employees

When workers are incorrectly classified, it can lead to wage claims. There are two common types of misclassification:

Independent Contractors

Some employers may classify employees as independent contractors to avoid paying benefits, overtime, and adhering to certain labor laws. However, if these workers function as employees, this misclassification can lead to wage claims.

Exempt Employees

Misclassifying non-exempt employees as exempt (from overtime, for instance) can also lead to wage issues. Exempt employees typically have different job duties and salary levels and are not eligible for overtime pay. Incorrectly classifying non-exempt employees as exempt can result in unpaid overtime wages.

Failure to Pay Overtime

Under many labor laws, such as the Fair Labor Standards Act in the United States, employers are required to pay overtime to eligible employees for hours worked beyond the standard workweek (often 40 hours). If employers fail to compensate for overtime, this can lead to wage claims. This issue is closely linked with misclassification, as employers might incorrectly label employees as exempt to avoid paying overtime.

Minimum Wage Violations

Employers are obligated to pay their employees at least the minimum wage, which varies depending on the jurisdiction. Paying employees less than the mandated minimum wage is a violation of labor laws and can result in wage claims.

Unpaid Work Hours

This encompasses situations where employees are expected to work without compensation. This can include:

Working Off the Clock

Expecting employees to perform job duties before clocking in or after clocking out without pay.

Not Compensating for All Hours Worked

This can happen in various forms, such as not paying for short breaks, mandatory training sessions, or certain preparatory and concluding activities related to the job.

In all these cases, employees may seek legal recourse to recover unpaid wages and other damages. It’s important for both employers and employees to understand their rights and obligations under labor laws to avoid wage claims and ensure fair compensation.

Types of Wage and Hour Violations

Wage and hour violations encompass a range of illegal practices employed by employers to avoid paying workers their due wages or to circumvent the protections provided by labor laws. These violations can significantly impact employees, depriving them of earned income and undermining workplace rights. Understanding these violations is crucial for employees to protect their rights and for employers to comply with the law. If you believe you’ve been a victim of such violations, consulting a wage claim lawyer in Washington, DC, like those at Eric Siegel Law, can provide you with the guidance and representation you need to assert your rights and recover any unpaid wages.

Overtime Wage Violations

One common form of wage violation occurs when employers fail to pay the legally required overtime rates. According to federal law, employees are entitled to one and a half times their regular rate of pay for hours worked beyond 40 in a workweek, unless they fall into an exempt category. Some employers may attempt to skirt these laws by misclassifying employees as exempt, not counting all hours worked, or failing to pay the overtime rate. We at Eric Siegel Law are committed to ensuring that workers receive the overtime pay they are rightfully owed.

Minimum Wage Violations

Another prevalent issue is the failure to pay the minimum wage. The federal minimum wage acts as the lowest legal hourly pay for many workers, but some states and cities, including Washington, DC, have higher minimum wage requirements. Employers violate wage laws by paying workers less than the applicable minimum wage. This practice not only harms employees financially but also violates fundamental labor standards. Our team is ready to assist workers in recovering unpaid wages resulting from minimum wage violations.

Illegal Deductions and Unpaid Hours

Employers sometimes make illegal deductions from employees’ wages, for items that the employer should cover or for reasons not permitted by law. Additionally, employees may not be compensated for all the hours they work, including time spent preparing for work (donning and doffing), working through breaks, or performing post-shift duties. If you’ve experienced these or similar issues, it’s vital to speak with a wage claim lawyer in Washington, DC, from Eric Siegel Law. We can help you understand your rights and the steps necessary to pursue compensation.

Misclassification of Employees

Misclassification of workers as independent contractors instead of employees is a tactic some employers use to avoid paying overtime, benefits, and taxes. This misclassification can deprive workers of significant rights and benefits. Identifying and addressing misclassification is complex, requiring legal expertise to navigate the nuances of employment law. Our attorneys are adept at identifying misclassifications and advocating for the rights of misclassified workers.

Retaliation Against Employees

Retaliation against employees who exercise their rights under wage and hour laws is not only unethical but also illegal. This can include demotions, reductions in hours, termination, or other punitive actions taken because an employee filed a complaint, reported violations, or participated in an investigation. At Eric Siegel Law, we stand ready to protect employees from retaliation, ensuring they can assert their rights without fear of unjust consequences.

Consequences of Wage Claims

Consequences of Wage Claims

One of the primary areas of focus for wage claim lawyers is ensuring that employees are paid in accordance with federal and state wage laws. These laws set forth guidelines regarding minimum wage, overtime pay, and other elements crucial to determining fair compensation. A wage claim lawyer carefully examines the specifics of each case, assessing whether an employer has violated these laws and subsequently formulating a legal strategy to rectify the situation.

The consequences of wage claims extend beyond financial repercussions and can impact both employees and employers.

For Employees:

- Financial Stress: Unpaid wages can cause significant financial hardship for employees.

- Legal Challenges: Pursuing a wage claim can be a lengthy and complex process.

- Workplace Relations: Filing a claim can strain relations with employers and colleagues.

For Employers:

- Legal and Financial Penalties: Employers may face fines, penalties, and the obligation to pay back wages.

- Reputation Damage: Wage disputes can harm an employer’s public image and employee morale.

- Administrative Burden: Addressing wage claims can consume significant time and resources.

Overtime disputes often find their way onto the desks of wage claim lawyers. Federal and state laws mandate that eligible employees be compensated at a higher rate for hours worked beyond the standard 40-hour workweek. However, disputes can arise when employers fail to adhere to these regulations, denying employees the additional compensation to which they are entitled. In such instances, a wage claim lawyer steps in, navigating the legal intricacies to ensure that employees receive the overtime pay they have earned.

Unpaid wage claims are another terrain where these legal professionals shine. Instances where employers fail to remunerate employees for their labor or attempt to cut corners in compensation packages can lead to legal battles. Wage claim lawyers assess the validity of such claims, pursuing legal avenues to secure the owed wages for their clients.

In addition to navigating federal labor laws, wage claim lawyers often deal with state-specific regulations that can further complicate matters. Each state may have its own set of labor laws, and a skilled wage claim lawyer possesses an in-depth understanding of these nuances. This regional expertise allows them to tailor their approach to the unique legal landscape of each jurisdiction, ensuring a comprehensive and effective legal strategy.

Beyond addressing specific wage-related disputes, wage claim lawyers also serve as advocates for systemic change. They contribute to the broader discourse on workers’ rights, participating in efforts to shape and reform labor laws. By doing so, they not only secure justice for individual clients but also work towards fostering a more equitable and fair work environment on a larger scale.

The role of a wage claim lawyer extends far beyond the courtroom. These legal professionals stand as defenders of employees’ rights, working tirelessly to rectify injustices and promote a workplace culture where fair compensation is not just an ideal but a tangible reality. At Eric Siegel Law, we are here to help you with your wage-related dispute.

Wage claims arise when employees believe they have not been paid the full amount they are owed by their employer. These can stem from a variety of causes and have significant consequences for both employees and employers. As a professional entity like Eric Siegel Law, specializing in wage claim law in Washington, DC, we understand the complexities of these cases and the importance of addressing them with expertise and care.

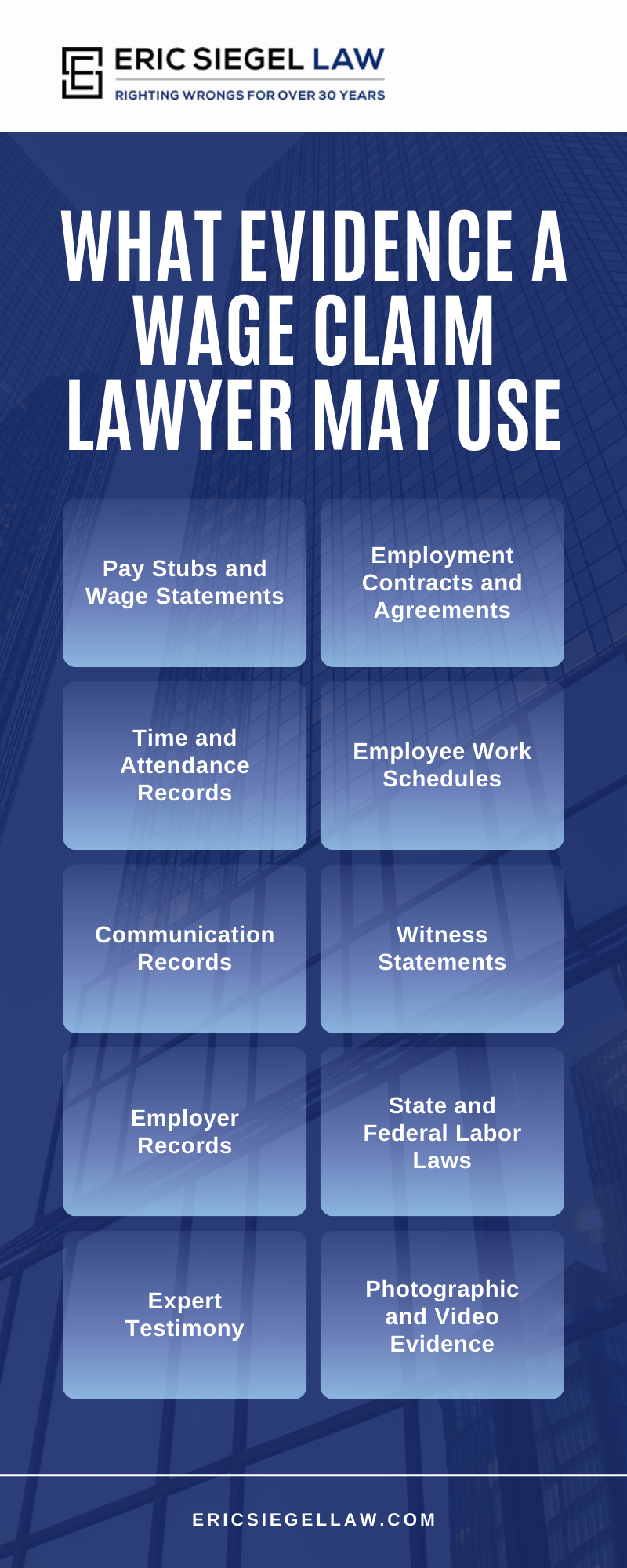

What Evidence a Wage Claim Lawyer May Use

What Evidence a Wage Claim Lawyer May Use

A Washington, DC wage claim lawyer specializes in helping employees recover unpaid wages and pursue legal action against employers who have violated wage and hour laws. These attorneys play a crucial role in ensuring that workers receive fair compensation for their labor. To build a strong case in a wage claim, lawyers from Eric Siegel Law may rely on a variety of evidence to support their clients’ claims.

Pay Stubs and Wage Statements

One of the most fundamental pieces of evidence in a wage claim case is the employee’s pay stubs and wage statements. These documents provide a clear record of the hours worked, hourly rate, deductions, and total earnings. Discrepancies between the information on pay stubs and the actual wages paid can be strong evidence of wage violations.

Employment Contracts and Agreements

Employment contracts, offer letters, and other written agreements between the employer and employee can be valuable sources of evidence. These documents may outline wage rates, bonuses, commissions, overtime policies, and other compensation-related terms.

Time and Attendance Records

Accurate records of an employee’s work hours are essential in wage claim cases, particularly for overtime and minimum wage violations. Lawyers may use timecards, punch-in/punch-out records, electronic attendance systems, and any other time-tracking mechanisms to demonstrate the hours worked.

Employee Work Schedules

Your Washington wage claim lawyer knows that work schedules can be compared to actual work hours to identify instances of unauthorized overtime, scheduling violations, or missed meal and rest breaks, which may result in wage claims.

Communication Records

Emails, text messages, or written communication between employees and their supervisors or HR departments can serve as evidence. These records can show discussions about work hours, wages, overtime, or any disputes related to compensation.

Witness Statements

Witness statements from coworkers who experienced similar wage violations or who can attest to the working conditions, practices, and policies can be crucial in wage claim cases. These statements provide additional perspectives and corroborate the employee’s claims.

Employer Records

Lawyers may request internal documents from the employer, such as payroll records, timesheets, and financial statements, to cross-reference with the employee’s claims and identify discrepancies.

State and Federal Labor Laws

Lawyers will reference state and federal labor laws and regulations to determine whether the employer has violated any wage and hour laws. Violations of minimum wage, overtime, or other labor standards can form the basis of a wage claim.

Expert Testimony

In complex cases, wage claim lawyers may enlist the services of expert witnesses, such as forensic accountants or wage and hour experts, to analyze financial records, calculations, and employment practices and provide expert opinions on the validity of the claims.

Photographic and Video Evidence

Visual evidence, such as photographs or videos of timekeeping systems, work conditions, or any relevant activities, can support the employee’s claims.

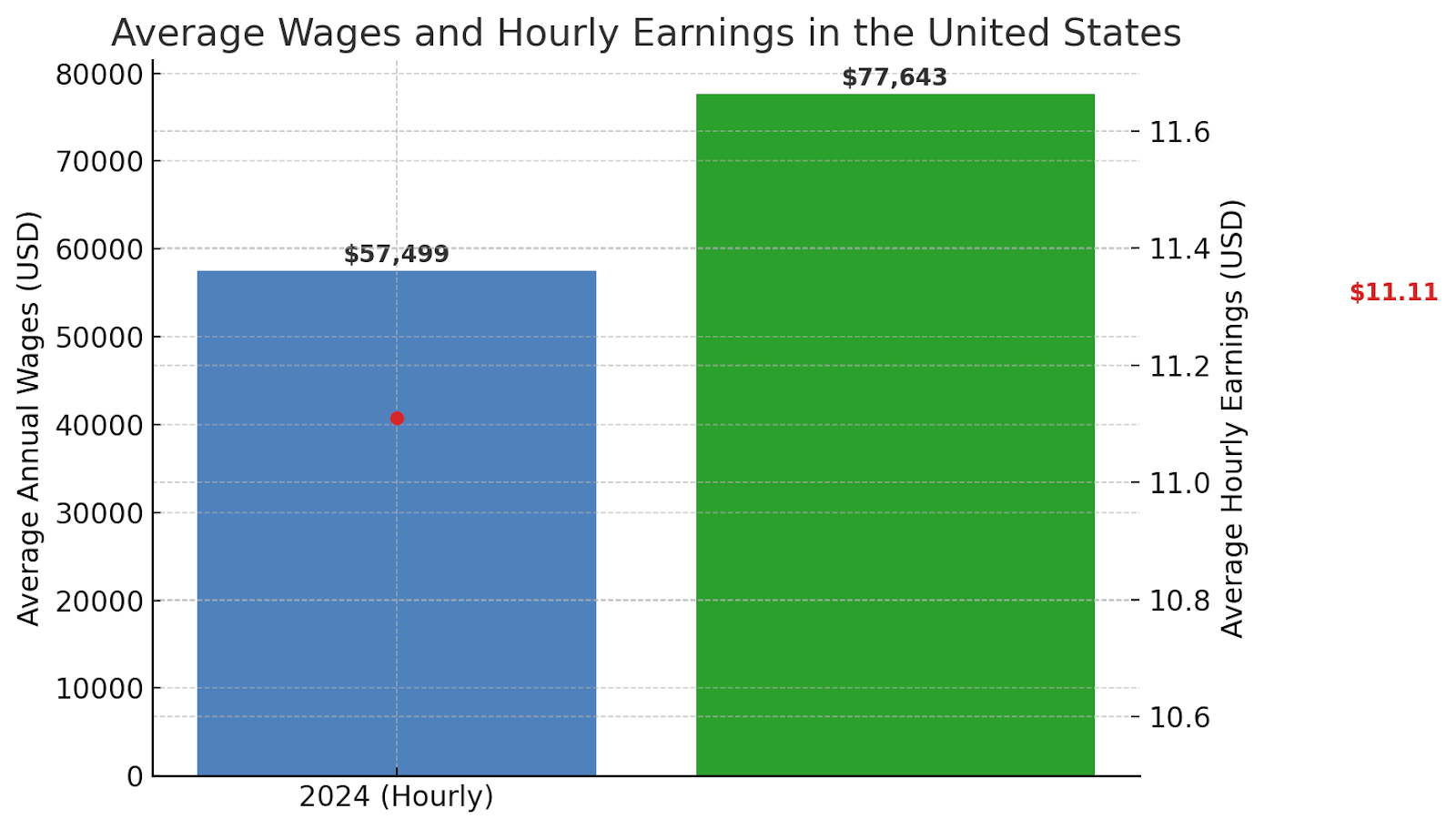

Wage Claim Infographic

Washington D.C. Wage And Hour Statistics

According to the Statista Research Department, in 2022, the average annual wages in the United States came to $77,643. The number has grown incrementally over the last decades with the annual average having been $57,499 in 2000. As of March 2024, the average hourly earnings in the U.S. is $11.11. If you are having wage issues, contact our office to see how we can help.

Frequently Asked Questions About Wage Claims In Washington DC

Frequently Asked Questions About Wage Claims In Washington DC

What Does a Wage Claim Lawyer in Washington, DC Do?

A Wage Claim Lawyer in Washington, DC specializes in representing employees who have not been paid the wages they are legally owed by their employers. This includes handling cases of unpaid overtime, minimum wage violations, unlawful deductions, and misclassification of employees as independent contractors. These lawyers are well-versed in both federal and District of Columbia labor laws, ensuring that employees receive fair treatment and compensation for their work.

How Can a Wage Claim Lawyer Help Me?

If you believe you have not been paid what you are owed, a Wage Claim Lawyer can offer expert legal advice and representation. They can help you understand your rights, determine if you have a valid claim, and represent you in negotiations or court proceedings against your employer. These lawyers aim to recover unpaid wages, and in some cases, additional damages and attorney’s fees, ensuring that your rights as a worker are protected and upheld.

When Should I Contact a Wage Claim Lawyer in Washington, DC?

You should contact a Wage Claim Lawyer as soon as you suspect a wage violation. This might include situations where you haven’t been paid overtime despite working extra hours, you’re receiving less than the minimum wage, or your paycheck seems consistently lower than it should be. Prompt action is crucial, as there are time limits for filing wage claims under both federal and DC law.

What Should I Bring to My First Meeting with a Wage Claim Lawyer?

When you first meet with a Wage Claim Lawyer, it’s important to bring any documents and information related to your employment and the wages you believe you are owed. This includes pay stubs, time sheets, employment contracts, and any correspondence with your employer regarding your wages. This information will help the lawyer assess your situation and advise on the best course of action.

Wage Claim Glossary

Employees facing unpaid wages, overtime issues, or misclassification may benefit from the support of a legal professional. A Washington, DC wage claim lawyer can assist in recovering lost earnings and addressing violations of labor laws. Below are key terms and legal concepts that commonly arise in wage claim cases. Understanding these can help you take the right steps toward protecting your rights and seeking proper compensation.

Unpaid Overtime

Unpaid overtime refers to situations where employees work more than the standard 40-hour workweek but do not receive the increased pay rate required by law. Under the Fair Labor Standards Act (FLSA), non-exempt employees are entitled to one and a half times their regular hourly rate for overtime hours. In Washington, DC, failure to pay this rate is a violation that may lead to a wage claim. Employers often misclassify employees or under report hours to avoid paying overtime. Accurate time records and pay stubs are essential to proving a case involving unpaid overtime.

Employee Misclassification

Employee misclassification occurs when an employer labels a worker as an independent contractor or an exempt employee to avoid legal obligations such as overtime pay and benefits. Independent contractors are not subject to the same wage protections as employees. Similarly, exempt employees—typically those in executive, administrative, or professional roles—are not eligible for overtime. However, when a worker performs duties that do not meet the legal criteria for these exemptions, the misclassification can be challenged. This is a common basis for wage claim disputes and requires a detailed analysis of job duties and work arrangements.

Off-the-Clock Work

Off-the-clock work describes any job-related task an employee is required to perform without being paid for it. This may include activities such as preparing a workstation before the start of a shift, attending mandatory meetings, or completing closing procedures after clocking out. Even small amounts of unpaid time can accumulate into a significant wage violation if they are part of the employee’s routine duties. Employers are required to pay for all hours worked, regardless of when or where the work occurs. Failure to do so is a violation of both federal and DC wage laws.

Illegal Wage Deductions

Illegal wage deductions involve an employer removing money from an employee’s paycheck for items or reasons that are not authorized under the law. This may include deductions for equipment, uniforms, or mistakes made on the job. Unless explicitly permitted and agreed upon, these types of deductions are generally unlawful, especially if they reduce an employee’s earnings below the minimum wage. Wage claim lawyers examine payroll records, written policies, and employment agreements to determine whether deductions were proper or if they qualify as wage violations.

Retaliation For Wage Complaints

Retaliation occurs when an employer takes negative action against an employee for asserting their wage rights. This could include termination, reduction in hours, demotion, or unfavorable schedule changes. Such actions are illegal under both federal and local laws. Employees have the right to report wage violations without fear of losing their job or facing punishment. When retaliation is proven, employees may be entitled not only to recover unpaid wages but also to additional compensation for the retaliatory behavior. Legal support is often necessary to gather evidence and pursue a claim effectively.

At Eric Siegel Law, we assist workers across Washington, DC with wage claim disputes involving unpaid overtime, misclassification, and other common wage violations. If you believe you’ve been underpaid or mistreated due to a wage issue, we are here to discuss your situation and help you determine your next steps.

Contact us today to speak with a wage claim attorney. We’re here to review your case and help you move forward with confidence.

Eric Siegel Law, Washington Wage Claim Lawyer

888 17th St NW, Washington, DC 20006

For Legal Help Contact Eric Siegel Law

At Eric Siegel Law, as a dedicated Wage Claim Lawyer in Washington, DC, I deeply understand the widespread issues surrounding wage claims. These problems touch workers across all levels of the economy, stemming from a complex mix of factors. Often, these issues arise due to exploitative practices by some employers and the intricate details of labor laws. The impact of these issues is profound, leading not only to financial distress for employees but also eroding the trust that is crucial in any workplace environment.

However, there is a path forward. By leveraging government interventions, empowering workers, and advocating for industry-wide changes, we strive to address these challenges head-on. Our goal at Eric Siegel Law is not just to mitigate these issues but to champion fair compensation for all workers. This mission is more than a matter of economic justice; it’s a fundamental step towards creating a more equitable and sustainable workforce for everyone.

Consequences of Wage Claims

Consequences of Wage Claims What Evidence a Wage Claim Lawyer May Use

What Evidence a Wage Claim Lawyer May Use

Frequently Asked Questions About Wage Claims In Washington DC

Frequently Asked Questions About Wage Claims In Washington DC